We can help you obtain an Ag Exemption for 1-D-1 Open Space requirement.

You can qualify for an Ag Exemption with as little as 5 acres.

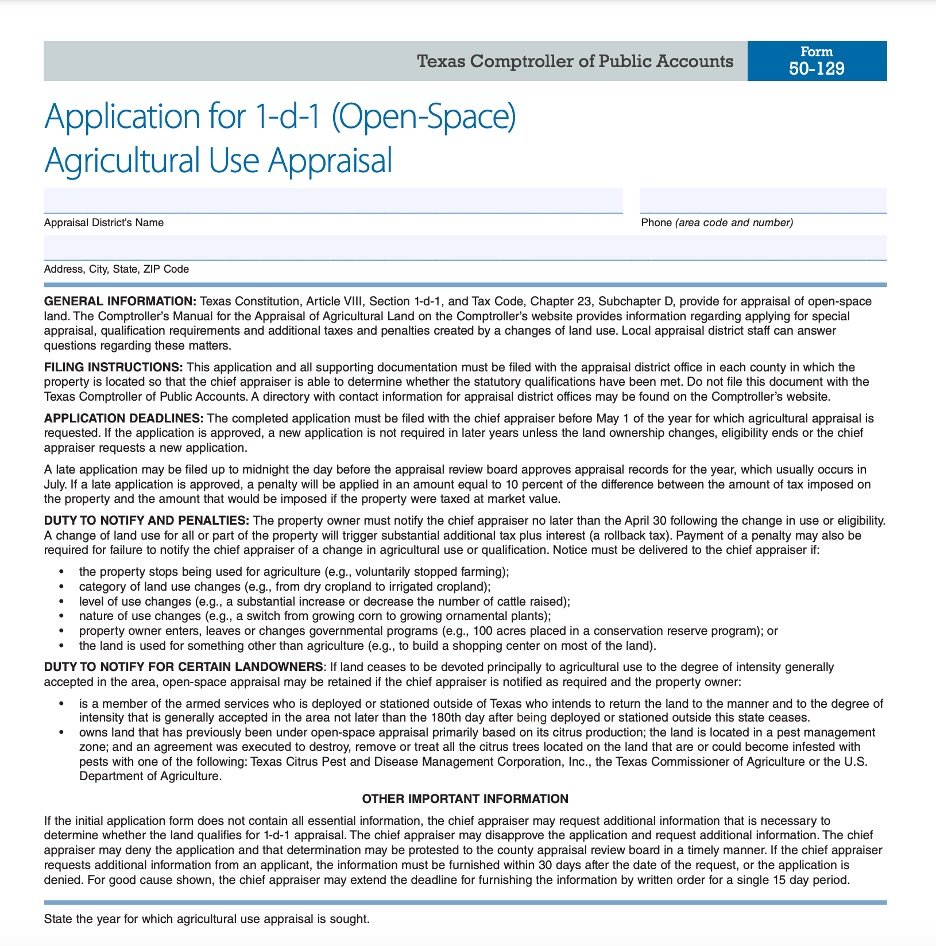

As with most aspects of dealing with the government, the process is complex and sometimes daunting. We can help you navigate through those requirements to help you save money on taxes. While these services are not free, we hope that we can save you even more in taxes than they cost. In some cases, once an Ag Exemption is granted, the landowner can then switch their Ag Exemption Classification from beekeeping to wildlife, greatly reducing the requirements that are needed to maintain the Ag Exemption moving forward. Obtaining an Ag Exemption on your property will not only reduce your tax burden but increase your property’s resale value as Ag Exemptions are transferable to buyers

FAQs

-

Yes, a law change in 2012 to the Texas Tax Code under Chapter 23, Subchapter D, Section 23.52 (1) and (2) now allows landowners to qualify for a special valuation on their land if it is used for beekeeping (AKA Ag Exemption). This applies to parcels of land between 5-20 acres

-

The law states that properties as small as 5 acres and up to 20 acres qualify. More than 20 acres can qualify under special conditions but it is often easier and cheaper to apply for an Ag Exemption using another method such as hay production or native pasture

-

This depends on many factors, but generally once an Ag Exemption/Special Valuation is granted, you will then be paying taxes on the production value of the land rather than its appraised value. Current production value per acre in Brazoria County is set to $385.00 per acre for bees. Other things to consider is that you land will have a higher resale value due to its special valuation. This valuation stays with the land and is transferable to the new owners. We have successfully lowered a clients taxable value from $34,410/acre to $385/acre which greatly reduced the amount of taxes owed while simultaneously increasing resale value.

-

Yes, this is often the case with many landowners. Landowners will often switch their land from bees to wildlife after obtaining their exemption. The reason for this is two fold; 1.) you must already have an Ag Exemption in order to switch your property to wildlife exemption, 2.) Wildlife exemption is easier to maintain than keeping bees.

-

If the property has not been in any previous production activities, it will take a minimum of 5 years to obtain an Ag Exemption. Possibly 6 depending on when you apply. The laws state that the land must be in production in the last 5 out of 7 years.

-

Really there is no difference. The laws specifically call it a Special Valuation but everyone commonly refers to it as an Ag Exemption. We use the terms interchangeably.